Medical technology and device manufacturers are eyeing the Indian healthcare market for business growth. This is leading to higher penetration of healthcare services and related infrastructure in second and third tier cities in the country

Medical technology and device manufacturers are eyeing the Indian healthcare market for business growth. This is leading to higher penetration of healthcare services and related infrastructure in second and third tier cities in the country

The global medical technology market was estimated to be worth USD 273.3 billion in 2011, with an observed growth rate of 5.3 percent estimates by Espicom report. America and Europe together represent approximately 75 percent of this market. The Indian market is the fourth largest in Asia after Japan, China and South Korea. In terms of industry segments, Orthopedic, Dental and Prosthetic technologies emerge as the largest category, representing one-fifth of the global market, followed by Electrodiagnostics, Imaging and Patient Aids. As innovation in technology advances, latest medical equipment is being designed for better clinical outcomes, less invasive procedures and shorter recovery times.

Growth catalyst

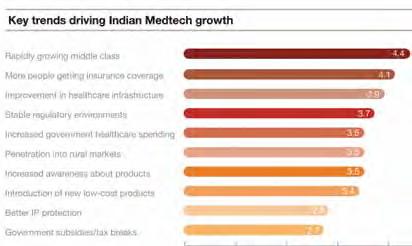

The reasons for healthy growth for medical equipment manufacturers eyeing Indian market are many; these include population rise, higher government and private sector investments in healthcare, increase in number of health insurance beneficiaries, rise in disease burden especially of non-communicable diseases (NCDs) such as cardiovascular diseases, diabetes, cancer, stroke and chronic lung diseases. Contrary to popular belief, the poor population is more vulnerable to these owing to limited access to quality health care. Thus demand for medical electronic equipment devices and disposables, examples X-Ray and imaging equipment, pathological probes are expected to rise. Restricted by the challenges of access and affordability, India is emerging as a destination for innovation in medical technologies that are manufactured in India for the Indian population. According to PwC Medical Technology Innovation Scorecard,

the nature of innovation is changing as developing nations become the leading markets for smaller, faster, more affordable devices that enable delivery of care anywhere at lower cost. As global companies embark upon India with manufacturing and R&D capabilities, and domestic manufacturers explore technology innovation and convergence, the pace, the times ahead will witness many small, medium and large medical technology companies creating value for patients as they benefit from new lower cost diagnosis, monitoring and treatment procedures.

Synergise to succeed

Synergise to succeed

India is an emerging market for many global medical technology manufacturers and has conventionally focused mainly in the upper and premium segments and geographies. According to latest PwC report, India ranks among the top three emerging nations for direct investment by large, multinational medical technology companies, and showed annual growth exceeding 15 percent and estimated industry revenue of about USD 3 billion in 2011 in the medical technology segment. Faced with saturation and competition, the industry is now re-thinking its growth strategy beyond the traditional model. On the domestic front, the Indian medical technology manufacturers are working hard on the innovation run to cater to the healthcare needs of mushrooming middle- and lower-income populations living in cities as well as in rural and per-urban areas that is expected to grow from close to 50 million people in 2007 to 580 million by 2025. The shift from urban to rural will not be easy for the medical technology industry that has been dependent on imports for most of its needs. Main categories of items that are imported into India contain imaging equipment, pacemakers, orthopedic and prosthetic appliances, breathing and respiration apparatus, and dental equipment. Hence, synergy between equipment manufacturers and hospitals to introduce new range of low cost products and business models will ensure the true realisation of market potential in India. The future will witness more R&D, innovation and manufacturing of medical technologies within India with new, tailormade and comprehensive solutions.

Designed for patient experience

The medical technology has traditionally developed its design and technology with new advancements as pure iterations

to their previous equipments as incremental innovations as enhancements in the power, efficiency or performance. However, in recent times as the industry moves from a clinician-centric approach to a patient-centric approach, the new

trends in medical device designs reflect the new ideology of this industry to reinvent healthcare as an experience from the patients viewpoint and the doctor as just a facilitator. In its Medical Technology Report 2012, Ernst & Young state that the move to an outcomes-focused ecosystem will involve a changing customer base. While the primary customer for many medical technologies has historically been the physician, medical technology firms will now need to focus on understanding and serving a more diverse set of customers. The patient empowerment is being provided from technology platforms such as smartphone apps, social media platforms, sensor-embedded smart devices and more. Most of the equipments mainly diagnostic in function hold the patient data with them. This data when stored in electronic form, which makes it easier to analyse trends and combine data for the patient each time they visit, providing better customer experience for the hospital. Thus new medical equipment designs will now include features for a hassle-free patient experience in addition to high performance for the clinician.

| Key Challenges Faced by the Sector Low penetration & geographic reach Accessibility Affordability Awareness Nascent Regulatory Environment Low Indigenous Manufacturing No Distinct Status of the Industry Need for Quality Benchmark at par with the Global Standards Complex Rules and Guidelines High Capital requirement |

Underserved markets

A large segment of the Indian population is yet to experience quality healthcare in their cities and are forced to comprise with ill-equipped hospitals and clinics. The focus of the medical technology industry is to significantly increase focus on these underserved middle-income population in tier two segments. Move beyond importing current mature market products to customised offerings, shift from technology product innovation to value-based innovation, and establish new business models; the demand for refurbished equipments has also caught pace in these market segments. Many domestic manufacturers have found a level-playing in these segments and offer a cost advantage over multi-national companies. Thus overall, apart from establishing local and regional operational capabilities to deliver the new innovations, including a low-cost manufacturing network, local research and development (R&D), domestic competition

will also play a significant role in plans to foray in these underserved markets.

A lucrative market for many global medical technology and device manufacturers, the profit margins from India for business has been elusive for many companies in the past. The delay in procurements, harsh environments, and lack of maintenance and upgrade of technologies has left much to be desired to provide quality healthcare services to the burgeoning Indian population. Thus companies need to think out-of-the-box strategies, innovation in product designs and materials to tap Indian healthcare markets.

Be a part of Elets Collaborative Initiatives. Join Us for Upcoming Events and explore business opportunities. Like us on Facebook , connect with us on LinkedIn and follow us on Twitter , Instagram.