There is a need to allocate more funds towards public health in the country and attain universal health coverage. The government along with the private companies are working in partnership to establish a better healthcare delivery system. With the initiative of Make in India and Digital India underway and setting up of new AIIMS, eHealth magazine takes a look at the growth of healthcare industry in the country and the challenges that remain to be tackled as the government tries to maintain a balance between pre-election promises and the post-win fiscal ground realities.

There is a need to allocate more funds towards public health in the country and attain universal health coverage. The government along with the private companies are working in partnership to establish a better healthcare delivery system. With the initiative of Make in India and Digital India underway and setting up of new AIIMS, eHealth magazine takes a look at the growth of healthcare industry in the country and the challenges that remain to be tackled as the government tries to maintain a balance between pre-election promises and the post-win fiscal ground realities.

The healthcare industry has become one of the largest sectors in terms of revenue and employment and the sector continues to escalate. CII reports that the industry is eyed as the worlds most potential industry with total revenues of approximately US$ 2.8 trillion and within the country this largest industry has approximate revenue of US$ 30 billion constituting five per cent of GDP with an employment to around four million people. According to a data released by the Department of Industrial Policy and Promotion (DIPP), the hospital and diagnostic centres attracted Foreign Direct Investment (FDI) worth US$ 2,793.72 million between April 2000 and January 2015. While opportunities galore, there still lies a huge mismatch between the private and public spent on healthcare.

Indias public expenditure on health averages one per cent of gross domestic product (GDP), while the global norm ranges around 4-5 per cent. This is the lowest when compared to Chinas 3 per cent, Brazils 4.1 per cent and 8.3 per cent of the US. The country urgently needs to raise public health spending to at least 2.5 per cent of GDP if the NDA governments promise of universal health coverage is to be fulfilled.

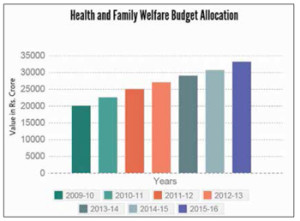

The budgetary allocation for healthcare in 2015-16 is Rs 33,152 crore, a little over Rs 30,645 crore for 2014-15. Significantly, last year, in order to meet its fiscal deficit target, the government had abruptly cut the health budget to Rs 24,400 crore. This sudden cut reflected the fiscal challenge the sector faces. Looking at the bigger picture, the total health spend in the first three years of the 12th Five-Year Plan has been about Rs 70,000 crore, way below the Rs 2,68,000-crore budgetary allocation in the 2012-17 period.

The budgetary allocation for healthcare in 2015-16 is Rs 33,152 crore, a little over Rs 30,645 crore for 2014-15. Significantly, last year, in order to meet its fiscal deficit target, the government had abruptly cut the health budget to Rs 24,400 crore. This sudden cut reflected the fiscal challenge the sector faces. Looking at the bigger picture, the total health spend in the first three years of the 12th Five-Year Plan has been about Rs 70,000 crore, way below the Rs 2,68,000-crore budgetary allocation in the 2012-17 period.

Roadblocks

There is a growing mismatch between the growing population and the number of hospitals in the country. Statistics reveal that the country has one hospital bed for 879 people. This is far below the world average of 30 hospitals per 10,000 population. India requires 6,00,000 additional beds over the next five to six years, which potentially throws an opportunity of more than US$ 30 billion in the offing at a rapid pace.

As eHealth has launched a campaign in a bid to understand the challenges in building new hospitals in the country (see story ahead in the issue), what makes the scenario even more daunting is the abysmal ranking the country holds in the ease of doing business in the country. Adding on to the existing challenges in the healthcare sector, the bottlenecks in the ease of doing business make it even a harder challenge for the players to push for growth. According to a CII-KPMG Ease of doing business in India report, to maintain its growth trajectory, India needs to be a relatively attractive investment destination across each of these parameters. The Government would need to undertake reforms to help place the country on an equal footing amongst countries having favourable, flexible, liberalised and a transparent business environment.

With Indians bearing maximum of their healthcare spending outof-pocket and with most medical equipment being imported for India, the piped dream of Prime Minister Narendra Modi, the Make in India concept may not be able to work for healthcare sector in the country. Pharma and healthcare are among the 25 identified sectors that have huge scope to draw foreign as well as Indian companies to manufacture in India. Modi had stated that the campaign can act as a catalyst to make healthcare accessible and affordable in India. But with lack offavourable tax policies, no ease of doing business being, Make in India seems to be a distant dream. Absence of hospital infrastructure and lack of trained and even availability of health professionals are some of the major roadblocks in the development of healthcare sector in the country.

Roll back on pre-poll promises

With a high priority to the health sector and a proposed universal health plan as part of its manifesto before elections, government is yet to make those promises a reality. Modi government has asked for a drastic cutback of an ambitious health care plan after cost estimates came in at US$18.5 billion over five years. The government had to go back on his pre-election promise owing to more budgetary allocations being made for the infrastructure sector leaving less funding available for social sectors to boost economic growth.

World Health Organization (WHO) has shared on the need for India to reorganise its healthcare delivery system with the right mix and distribution of services to achieve Universal Health Coverage (UHC). The heavy burden of out-of-pocket (OOP) expenditure incurred by people needs to be reduced and there is an urgent need for the government to increase public expenditure on health and develop mechanisms for cashless access to health services at all delivery points.

Key Growth Drivers for Healthcare Industry

Narendra Modis Modis manifesto ahead of the last general elections placed very high priority to the countrys health sector and promised a universal health assurance plan for 1.3 billion population. After coming to power in May last Year, Modi declared to unveil a draft policy on Universal healthcare in the country.

Following the suit of US Presidents flagship health programme, popularly called Obamacare, Modi asked his Health Ministry to prepare the draft plan on those lines in close coordination with the Prime Minister Office and World Bank. The union Health Ministry even set a deadline to roll out their plan from April 2015. In October last year, the ministry informed the Prime Ministers office that the universalising the health care for entire populace will incur roughly 25.5 billion dollars over four years to the national exchequer.

However, just three months later in January 2015, the health department submitted the plan to the prime minister with trimmed projected expenditure of US $ 18.5 billion over five years period. While the scheme has gone into the cold bag for now, industry experts feel that for the next year, the focus should be on fixing the issues in the domestic economy. The government needs to work on improving the Ease of Doing Business Index for the country, encouraging the social sector and making healthcare a priority sector, says Gautam Khanna, CEO P. D. Hinduja Hospital & Medical Research Center.

According to PwC, report the Indian healthcare industry is likely to witness sizeable growth (12% CAGR) by the year 2017. Various factors contributing to the growth of the industry there is a demand for healthcare services with the growing population, increasing urbanisation and improved lifeexpectancy; India is dealing with the burden of communicable and non-communicable diseases, the expansion of emerging middleclass group will impact the private consumption on healthcare which is set to increase from five per cent to 7.5 per cent by the end of the decade; health insurance stimulating the growth of healthcare delivery; investments by Private Equity (PE) and Venture Capital companies; medical tourism growing 35 per cent at present with quality care at affordable price.

Focus areas

According to a McKinsey report, for the healthcare sector in the country trod on the path of Acche Din, there is a need to increase the spend on healthcare by the government, infrastructure gaps will need to be closed, workforce scarcity and resource utilisation will need to be addressed. All these will require the government and the private sector to collaborate closely in an inclusive and transparent manner.

In India, 80 per cent of the healthcare expenditure is borne by the patients and that borne by the state is 12 per cent. The expenditure covered by insurance claims is three per cent As a result, the price sensitivity is quite high and the highlevel healthcare facilities are not in the reach of patients, says Dr Rajeev Boudhankar, Vice President, Kohinoor Hospital.

A few efforts have already been made to push the healthcare sector on the path to recovery. Government plans to improve access to healthcare with better hospital infrastructure, ameliorate rural healthcare delivery, better senior citizen healthcare, high prioritising chronic diseases, universalisation of emergency medical services. The government also aims to overcome the shortfall of healthcare professionals.

“There is an increased Demand for Health Information

Professor Suptendra Nath Sarbadhikari, MBBS, Ph.D., Project Director, Centre for Health Informatics, National Health Portal talks about mhealth to Elets News Network

Professor Suptendra Nath Sarbadhikari, MBBS, Ph.D., Project Director, Centre for Health Informatics, National Health Portal talks about mhealth to Elets News Network

What are the changes you have observed in the healthcare industry in the last one year?

There is an increased demand for health information, especially from the patients and their caregivers. Apart from getting health and disease information from the web, people are also using mobile applications to get information and often doing home care for medical conditions (mHealth/Tele-home care).

What are the key initiatives you think have changed the face of the healthcare industry?

A lot of useful mobile health applications are becoming available now. Wearable Health Devices are another area where tremendous growth is expected.

What is your departments immediate focus?

The National Health Portal (NHP) is aiming to be the first point of contact (through the Web and mobile applications) for any information related to health or disease. For the persons not yet having access to the Internet, we are going to have a toll free number for voice web through which people can call the number and get all the information available in the NHP. Moreover, the NHP will ultimately be available in all the 22 major languages of India (currently it is available in English, Hindi, Punjabi, Bengali, Gujarati and Tamil). Further, the portal is disabled-friendly too. Initially, it is an informational portal. However, with time, it is expected to evolve into transactional and transformational portal as well.

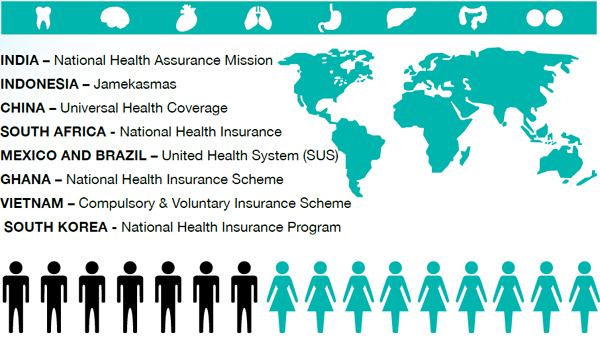

World Health PPPs

The healthcare services till now from the government were targeted at rural areas and more specifically at the poor. The National Health Programme shifts to universal healthcare, which means that everyone irrespective of income, age and employment will be covered by healthcare services

It also aims to implement integrated courses for Indian System of Medicine (ISM) and modern science Ayurgenomics. Reducing costs and out of pocket expenditure by bettering penetration of reimbursement plans, occupational health programmes, key focus on school health programmaking health and hygiene part of the curriculum. The increase in the usage of technology by taking mhealth and Digital India Project will further push the reach and the benefits of the healthcare sector in the country.

The public-private-partnership (PPP) in the healthcare industry will enable the government toleverage private-sector expertise and investment to service public policy goals. This in turn can open gates of opportunities for the private firms lowering the barriers to entering the industry. The PPP model will help improving health infrastructure and health services provisions. According to experts, super speciality hospitals and medical colleges, dialysis centres, radiology centres, mobile medical units, primary healthcare centres, skill development for HR are adopting the PPP model.

While efforts are on to create a developed world healthcare reach despite developing world infrastructure, government policies and funding will have to support the private players to make healthcare for all a plausible reality.

Be a part of Elets Collaborative Initiatives. Join Us for Upcoming Events and explore business opportunities. Like us on Facebook , connect with us on LinkedIn and follow us on Twitter , Instagram.