The demand for sophisticated diagnostic techniques and increasing acceptance of personalised medicines are the emerging areas attracting the companies to plunge into IVD market, writes Anshuman Ojha of Elets News Network (ENN)

Diagnostic tests are playing an increasingly important role in the provision of healthcare. Approximately 80 per cent of the information that physicians use to make medical decisions is produced by clinical laboratories and diagnostics are now seen as critical inputs into overall quality of patient care. Whereas clinical assay output a generation ago consisted of basic blood chemistry and infection tests, the modern clinical laboratory has grown to offer a large array of diagnostics for immunological, cardiovascular, cancer, chromosomal/ gene, and pharmacogenomic markers. Many of these tests are still based on classic techniques such as cell culture, staining, and microscopy, but advancements in molecular biology technologies over the past several decades have driven the rapid growth of molecular diagnostics.

Market Dynamics

The global in vitro diagnostics market was valued at US$ 47.30 billion in 2013; it is expected to reach US$ 62.63 billion in 2017, at a compound annual growth rate of 7.3 per cent. The market is segmented by product, technology, application, end-user, and region.

IVD Market – By Product

The IVD market, by product, is segmented into reagents and kits, instruments, services, and data management system/software. In 2014, there agents and kits segment accounted for the largest share of approximately 79.3 per cent of the IVD product market, and is expected to grow at a CAGR of 6.4 per cent during the forecast period. Growth in this segment is mainly attributed to the increasing demand for diagnostic tests and launch of new reliable, specific, and faster detection reagents.

The IVD market, by product, is segmented into reagents and kits, instruments, services, and data management system/software. In 2014, there agents and kits segment accounted for the largest share of approximately 79.3 per cent of the IVD product market, and is expected to grow at a CAGR of 6.4 per cent during the forecast period. Growth in this segment is mainly attributed to the increasing demand for diagnostic tests and launch of new reliable, specific, and faster detection reagents.

IVD Market By Technology

Based on technology global IVD market may be segmented as immunoas says, clinical chemistry, point-of-care, molecular diagnostics, haematology, coagulation, micrbiology and other clinical techniques. Point-of-care (PoC) is the highest revenue-generating segment in the overall IVD techniques market. Molecular diagnostics is the fastest growing technique in the in the overall IVD techniques market due to its ability to detect the primary cause of the disease accurately. It also represents the latest major technological additions to the clinical lab and remains the most dynamic and fastest growing product spaces. The reach of molecular diagnostics and its utility in many forms of clinical testing has contributed to growth in other IVD segments, such as histology, microbiology, and blood bank testing.

The global in vitro diagnostics market was valued at US$ 47.30 billion in 2013; it is expected to reach US$ 62.63 billion in 2017, at a compound annual growth rate of 7.3 per cent

IVD Market – By Applications

On the basis of applications, the IVD market is segmented into diabetes, infectious diseases, oncology, cardiology, HIV/AIDS, autoimmune diseases, drug testing, nephrology, and other applications. Infectious diseases generated the highest revenue for current and forecast period mainly due to rise in the incidences of infectious diseases. HIV/AIDS application market is the second largest revenue generating applications segment and would remain the second largest through 2020. The oncology segment is expected to grow at the highest CAGR of 9.6 per cent during the forecast period, owing to the increasing number of cancer patients across the world.

IVD Market By End-users

Hospitals, laboratories, academics, point-of-care testing and others are the end-users of global IVD market. Laboratories generate the highest revenue followed by point-of-care for global end-user market. Rise in the number of laboratories in Asia-Pacific regions and increased awareness about healthcare and its benefits are contributing towards the growth of laboratories market, which in turn drives the global IVD end-users market.

IVD Market By Geography

In 2014, North America commanded the largest share of the global IVD market, followed by Europe, Asia-Pacific, and the RoW. North America accounted for the largest share of 43 per cent of global IVD market in 2014. The large share of this region can be attributed to the presence of advanced technologies, superlative opportunities for molecular diagnostics in genetic testing and cancer screening, established distribution channels in the region,and the presence of a large number of leading market players.

|

In vitro diagnostics is an indispensible tool in modern medical practice in order to diagnose and treat diseases promptly and effectively. Technical advancements and rising healthcare awareness are key factors contributing to the growth of IVD market worldwide. Clinical chemistry segment is expected to lead in terms of market size among all other segments of IVD. Molecular diagnostics market is anticipated to witness highest growth rate in which oncology segment is expected to grow the highest owing to increasing number of cancer patients across the globe. IVD market tends to be driven by rising incidence of chronic lifestyle diseases in emerging economies, growing ageing population rising adoption of Point-of-Care (POC) testing and personalised medicine, says Dr Anju Gomber, Senior Consultant, Microbiology, Sri Balaji Action Medical Institute, New Delhi. |

The United States is a prime market due to the availability of government funds, expansion of molecular diagnostics for genetic disorders and cancer screening, and easy access to IVD tests through diagnostic service providers and major leading companies headquartered in US.

On the other hand, Asia-Pacific is the fastest-growing region in the global IVD market, mainly driven by the increasing demand for IVD tests from large patient population, increased spending capabilities of consumers on healthcare, improving healthcare infrastructure in the region, and increasing investment by leading players and respective government agencies in the region.

Market Trends

The global IVD market has evolved over the years with launch of number of innovative techniques having applications across multiple therapeutic areas. A new range of condition-specific markers and tests with advances in genomics and proteomics and increasing investment in emerging countries are creating new opportunities for this market. There are multiple trends shaping the future of the IVD market:

Point-of-care (PoC) testing: Patients would rather get tested in a doctors office or when they are in a medical clinic than have to get tested in a hospital. The move of testing to the PoC is driving growth in the market.

Need for speed: Medical diagnostics are getting pushed to deliver faster. This can be best seen in the explosion for raid and minimallyinvasive diagnostic tools.

Emerging markets demand: Some emerging markets are now able to pay for diagnostic devices where they weren’t able to just a few years back. Beyond other in vitro tests, in India alone, there are 100 million malaria tests per year.

Lab-on-a-chip: It is a technology through which bodily fluid sample scan be analysed on a small, disposable plastic chip. While lab-on-a-chip often is associated with point-of-care diagnostic testing, it also is likely to play a larger role in the traditional laboratory setting. In order to meet the growing capacity and maintain their revenue flows, labs will need to develop more innovative, lab-on-a-chip technology and better connectivity solutions that will require less materials, less reagent, fewer sample volumes, less labour, less time, and less cost.

➤ Growth Drivers

|

Mobile diagnostics: The use of mobile technology to better manage chronic diseases, diabetes in particular is likely to increase in the coming years for two key reasons.

Ageing population: Many countries are seeing a marked ageing in their populations. As this occurs, new tests and diagnostic technologies are necessary to cope with the changes.

However, inadequate reimbursement and stringent regulatory approval framework are restraining the growth of this market.

Market Share

The global in vitro diagnostics market is highly competitive with the top five major players, Roche Diagnostics, Siemens Healthcare, Johnson & Johnson, Danaher Corporation, and Abbott Laboratories, governing ~58.9 per cent of the total market share in 2014.

New product development and launch is the most preferred strategy acquired by leading market players followed by agreements, partnerships, collaborations, and joint ventures and mergers and acquisitions. Market players adopt these strategies to access new technologies, expand their product portfolio, enter into growing markets, and/or to increase their market share. In addition to the top market players, companies such as Alere Inc.; Becton, Dickinson and Company; Biorieux; Bio-Rad Laboratories; Hologic, Inc.; and Qiagen N.V. primarily focused on mergers and acquisitions to accelerate their global product offerings. Companies such as Arkray, Inc. and Dia Sorin S.p.A. adopted expansions as the dominant strategy to sustain their growth in the market. This increased competitiveness is expected to drive innovation in the market and thereby help the industry to solve existing challenges and meet the needs of end-users.

➤ Expanding HorizonsWhat are the current trends of IVD market and how fast is it growing? The in vitro diagnostics (IVD) market was valued at US$ 50 billion in 2012 and expected to reach nearly US$ 70 billion by 2017 according to a report by Research and Markets. There are multiple trends driving the growth of the in vitro diagnostic market, like many countries are seeing a marked ageing in their populations. As this occurs, new tests and diagnostic technologies are necessary to cope with the changes. Patients would rather get tested in a doctor’s office or when they’re in a medical clinic than have to get tested in a hospital. The move of testing to the Point-of-Care (PoC) is also driving growth in the market. What are some interesting applications in the IVD market? On the basis of applications, the in vitro diagnostic market is segmented into diabetes, infectious diseases, oncology, cardiology, HIV/AIDS, autoimmune diseases, drug testing, nephrology, and other applications. The oncology segment is expected to grow at the highest CAGR of 9.6 per cent between now and 2020, owing to the increasing number of cancer patients across the world. What would you say is the general state of the IVD industry as we come to the end of 2015? The in vitro diagnostic industry is experiencing a revival fuelled bya combination of technological improvements, cost pressures, reimbursement changes, rapid growth in molecular diagnostics and increasing interest in the genomics testing. Recent advances in molecular diagnostics technologies, including sequencing, PCR and microarray, are enabling greater sensitivity and precision in nucleic acid measurements, further expanding manufacturers’ offerings. Which types of technologies and products do you see as being the most successful in this new IVD environment? According to Simba Information, it is important to design and manufacture products that are right for the target audience and then to use scientific methods to prove that the products have a positive effect on patient care. Evidence-based medicine is becoming more critical for product success as advances in medical technology create increasingly sophisticated and thus more costly new tests. |

Major strategic developments take place in the field of cancer diagnostic technologies which exhibits high growth potential in the near future. Dominant market players such as Roche Diagnostics, QIAGEN N.V., Siemens Healthcare,and Abbott Laboratories, Inc. introduced several tests for cancer diagnosis in order to keep pace with the industry. The molecular diagnostics technology is also gaining popularity, primarily due to the increasing demand for personalised medicines.

➤ Restrains

|

The high demand for personalised medicines is a potential area that encourages companies to invest in the IVD reagents and devices market. Becton, Dickson and Company; Hologic, Inc.; Qiagen N.V.; DiaSorin S.p.A.; and Biorieux are some of the growing diagnostics companies focusing on the growth of their molecular diagnostics business predominantly through mergers and acquisitions. In addition, biomarkers are also facing emerging trends in the market that uncovers new growth opportunities for IVD companies. For instance, in June 2011, Qiagen NV acquired Ipsogen S.A. to leverage its pub broad range of assays covering 15 biomarkers for the prognosis, diagnosis, and monitoring of blood cancers. The acquisition enabled Qiagen NV to develop its business in molecular assays for profiling and personalised healthcare.

The high demand for personalised medicines is a potential area that encourages companies to invest in the IVD reagents and devices market. Becton, Dickson and Company; Hologic, Inc.; Qiagen N.V.; DiaSorin S.p.A.; and Biorieux are some of the growing diagnostics companies focusing on the growth of their molecular diagnostics business predominantly through mergers and acquisitions. In addition, biomarkers are also facing emerging trends in the market that uncovers new growth opportunities for IVD companies. For instance, in June 2011, Qiagen NV acquired Ipsogen S.A. to leverage its pub broad range of assays covering 15 biomarkers for the prognosis, diagnosis, and monitoring of blood cancers. The acquisition enabled Qiagen NV to develop its business in molecular assays for profiling and personalised healthcare.

The demand for sophisticated diagnostic techniques and increasing acceptance of personalised medicines are the emerging fields attracting the companies to plunge into IVD market.

Opportunities

|

Indian Market

Indian IVD market is one of the fastpaced and growing markets in the world. This is one of the focus markets for most of the organisations connected with it. The Indian in vitro diagnostics (IVD) market is valued at 3,000 crore, and is expected to reach `9,000 crore by 2018 growing steady at a CAGR of 20 per cent. IVD covers a diverse range of products from individual reagents to testing systems that consist of reagents, instrumentation, and software. Also included are accessories such as dedicated software as well as control and calibration materials.

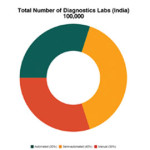

This remarkable growth can be attributed to increased healthcare awareness, desire to undergo preventive health checkups, availability of disease specific tests, corporate setups promoting health focus of employees, and drift from manual to semi-automated and automated equipment. It is estimated that India has around 100,000 diagnostic labs, out of which around 30 per cent are completely automated, 40 per cent are semi-automated, and 30 per cent are manual.

Increasing development in the corporate hospital infrastructure, evolution of automated instruments and emergence of new concepts like near patient testing, hospital laboratory management and customer relationship management has augmented the growth of Indian IVD market.

Lifestyle and communicable diseases are no longer restricted to urban centres, but are spreading to rural areas as well. As a large portion of rural areas do not have even the basic healthcare facilities, several cases remain undiagnosed. Certain statistics state that only one-third of the rural population has access to diagnostic centres. Most patients visit health centres outside the village for diagnosis and treatment. Nearly half of these public sector units don’t have treatment facilities for major chronic ailments.

Growing at a Constant RateWhat are the recent developments and trends in vitro diagnostics market?

Few noteworthy applications in the IVD market?

How has the IVD market performed this year?

Which types of technologies and products do you see as being the most successful in this new IVD environment?

How has the IVD industry evolved over the years?

|

These changing disease patterns, rising incidence of diseases, higher healthcare spending, and untapped markets create abundant opportunities for IVD manufacturers. Even hospitals are looking to reach out to patients in tier III cities and rural areas.

These changing disease patterns, rising incidence of diseases, higher healthcare spending, and untapped markets create abundant opportunities for IVD manufacturers. Even hospitals are looking to reach out to patients in tier III cities and rural areas.

IVD companies will not find it easy going in the unorganised and fragmented IVD market. The major reasons for the market fragmentation are the low entry barriers (leading to the mushrooming of laboratories) and the complete lack of standardisation. Less than 300 laboratories in India have accreditation, and due to the absence of legislation, standardised procedures and instruments are unavailable. Another significant concern for market participants is the inadequate insurance coverage. Responding to the demand for quality healthcare, most corporate laboratories have introduced cost effective and convenient patient care packages

Be a part of Elets Collaborative Initiatives. Join Us for Upcoming Events and explore business opportunities. Like us on Facebook , connect with us on LinkedIn and follow us on Twitter , Instagram.