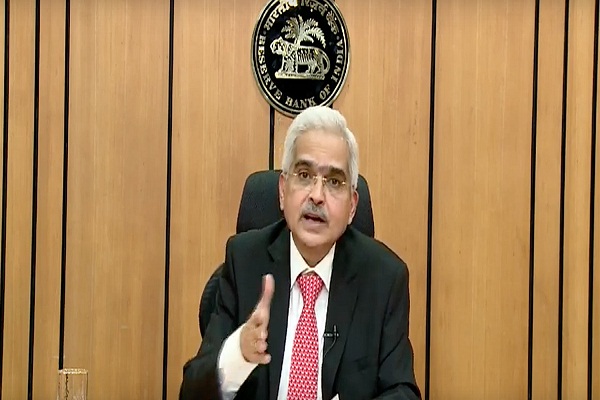

In the wake of Coronavirus led economic slowdown, the Reserve bank of India had recently made an appeal from banks to help borrowers to tide over the crisis. In its March 27 order it said all lending institutions, including banks and housing finance companies, will have to give its borrowers a three-month moratorium on term loans. The moratorium was for payment of all installment falling due between March 1, 2020 and May 31, 2020.

Here is a list of 10 important points:

1. A moratorium period is the technical term for a repayment holiday. It is basically a time relaxation for borrowers to make loan repayment.As per recent RBI’s directive, borrowers would get three months reprieve (from March 1 to May 31, 2020) to make EMI and loan payment

2. If bank allows the moratorium will be applicable on principal and/or interest components; bullet repayments; equated monthly installment (EMIs); and credit card dues

3. Moratorium period effectively allows a borrower to postpone repayment of liabilities and manage in planning his/her finances better. Generally banks and other financial institutions offer moratoriums to students taking education loans as they may take some time to finish study and get job.

4. The move is at some extent beneficial to those who are in dire situation due to economic stress. They have options to pay EMI after three months.

5. If you avoid paying the monthly installment on dues, then your interest will be calculated on a higher amount every month.

6. Under the present situation, if you don’t make payment it will not be considered as a defaults and will not affect your CIBIL score.

7. But the interest accrued during this period can come back to pinch your pocket when the moratorium ends as time period of installment may increases

8. Credit card holder and personal loan borrowers should not delayed the payment as high interest would cost you dearly in the long run

9. Banks are considering to oblige RBI. But for that Customers will either have to contact the bank if they want to take advantage of the moratorium or the bank will allow the three-month break by default. In the latter instance, customers will need to let the bank know in case they want to keep up with payments.

10. SBI has already announced that it will honour the RBI’s recommendation

Be a part of Elets Collaborative Initiatives. Join Us for Upcoming Events and explore business opportunities. Like us on Facebook , connect with us on LinkedIn and follow us on Twitter , Instagram.