A massive meltdown seems imminent. Look at these 3 charts/tables…

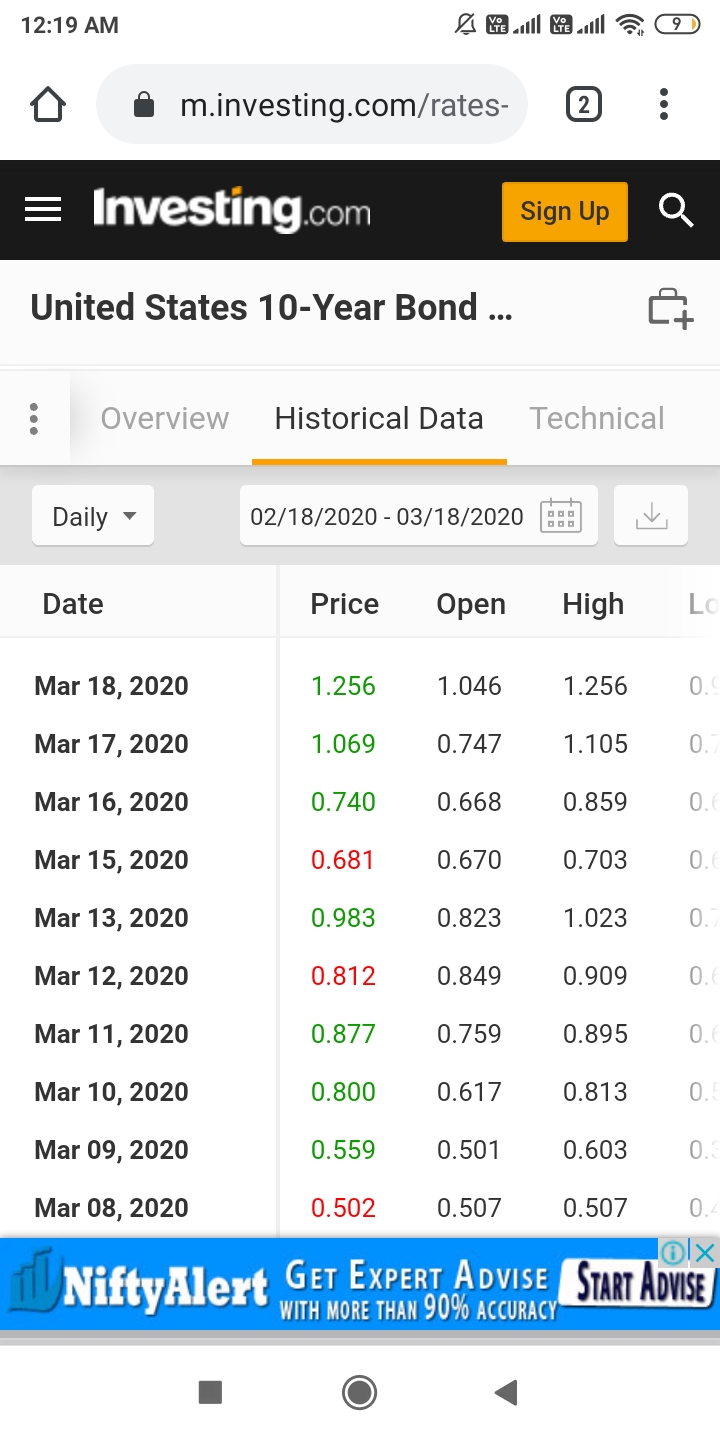

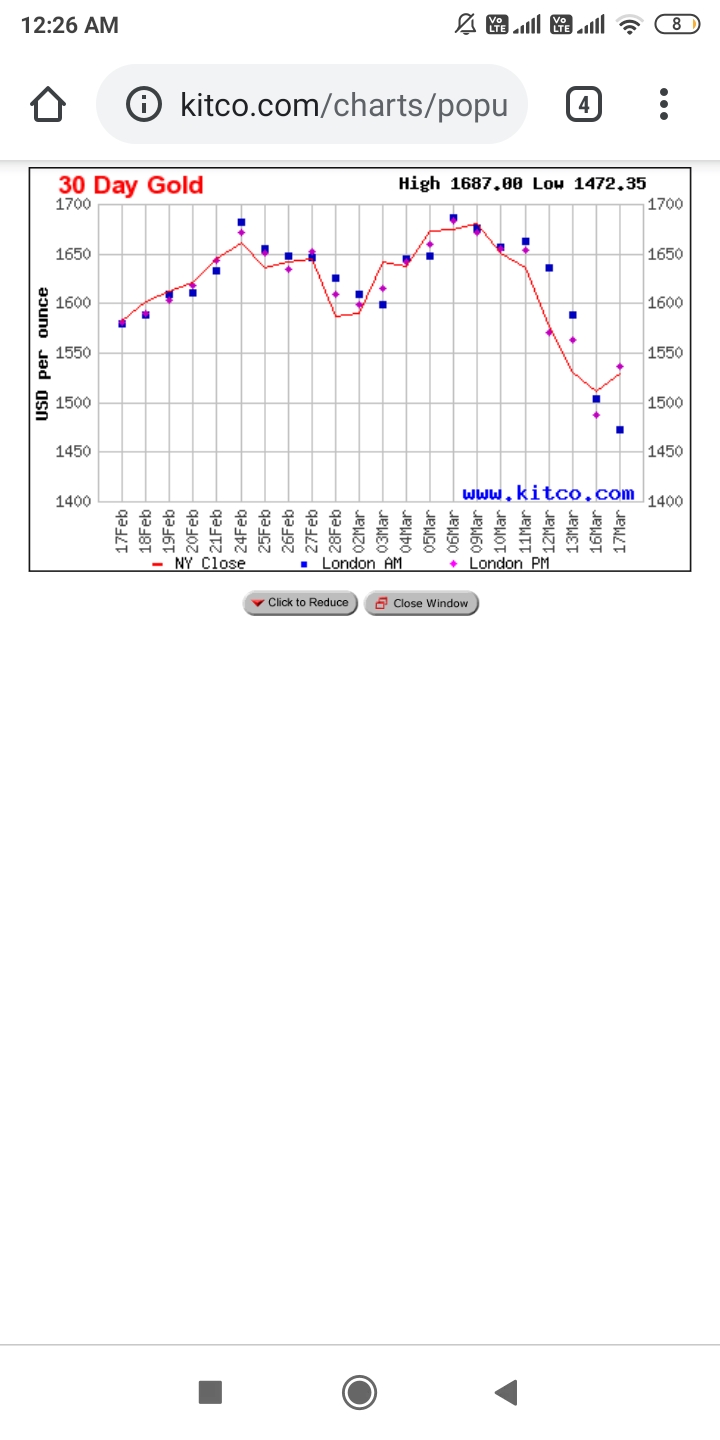

‘Typically’ when riskier assets like equities sell off, people rush to invest in safe heavens such as US government bonds and gold. However, since 8 March a strange thing is happening… US equities are falling (SnP 500 index from about 3000 to 2300 now). US treasury bonds are falling (10 year yields gone up from 0.5% to 1.26%).. Gold is falling (from about 1680 to 1500 now). Traditional correlations which held the markets have broken.

This means people are just selling. They have no money to invest. A massive global deleveraging is happening.. People are just selling off their assets to pay off their debts… A sells his stuff to pay B. B sells his stuff to pay C. C sells his stuff to pay D. Globally all debt is being paid off. Traditional paper money and banking system is based on leverage… Say government prints 100 dollars then banks keep on lending it again and again until it becomes 2000 dollars. The entire system works only on the trust that not everyone will call their debts at the same time.

But this is precisely what’s happening right now. So globally there is a massive destruction of money supply (leverage money) which is happening. So no one has enough money to buy anything, so price of all assets is coming down.

It’s like a global demonetization happening where new notes are not being printed. All wealth and money is being destroyed. Traditional banking system coming off. Ironically, the only immediate solution (solution mostly in the sense that it will kick the can down the road) seems to be massive printing of money and slashing of interest rates. This money may be used in giving tax cuts to the citizens by the government.

(WRITTEN BY Gaurav Agarwal, IAS, IIT & IIM Graduate, currently posted as Commissioner, Ajmer Development Authority)

Source: https://thesupermanreturns.wordpress.com/2020/03/19/global-deleveraging-demonetization-corona/

Be a part of Elets Collaborative Initiatives. Join Us for Upcoming Events and explore business opportunities. Like us on Facebook , connect with us on LinkedIn and follow us on Twitter , Instagram.

"Exciting news! Elets technomedia is now on WhatsApp Channels Subscribe today by clicking the link and stay updated with the latest insights!" Click here!