Amit Mookim, Partner, Strategy Services Group, National Industry Head “ Healthcare, KPMG, feels the investment scenario for Indian healthcare is changing for good

Amit Mookim, Partner, Strategy Services Group, National Industry Head “ Healthcare, KPMG, feels the investment scenario for Indian healthcare is changing for good

How well is the Indian healthcare sector doing in terms of attracting investment funding?

Healthcare is emerging as one of the top interest areas for private equity and venture capital investors. Rapid growth prospects, lack of scale in businesses and increasing market size in India makes it an interesting avenue for funding.

In your opinion what kind of investment trend the Indian healthcare is showing?

The sector is attracting funding from both domestic corporate, domestic investors and overseas investors. The reference is across various delivery models “ both asset light and scalable, such as eye care, ambulatory care, IVF

clinics, dialysis centres as well as multispecialty hospitals

What are the criteria that a PE/VC/ Insurance company looks at in a healthcare company before investing in?

Management team, depth of talent, economic soundness of the idea and ability to deliver, scalability of the model, ability

to exit in a finite timeframe, are some of the criteria that an investor looks at in the healthcare company. Apart from

funding, some investors play an active role in influencing strategy, getting management personnel on board, opening

new market opportunities/ contacts and institutionalising processes.

What is the exit policy that such investment company follows in healthcare?

Growing companies need several series of funding, and this is the same in healthcare. Some investors dilute partially

during ensuing exit rounds, but at the same time, in a sector like healthcare, given the size of companies, exit through IPO etc is still a distance away.

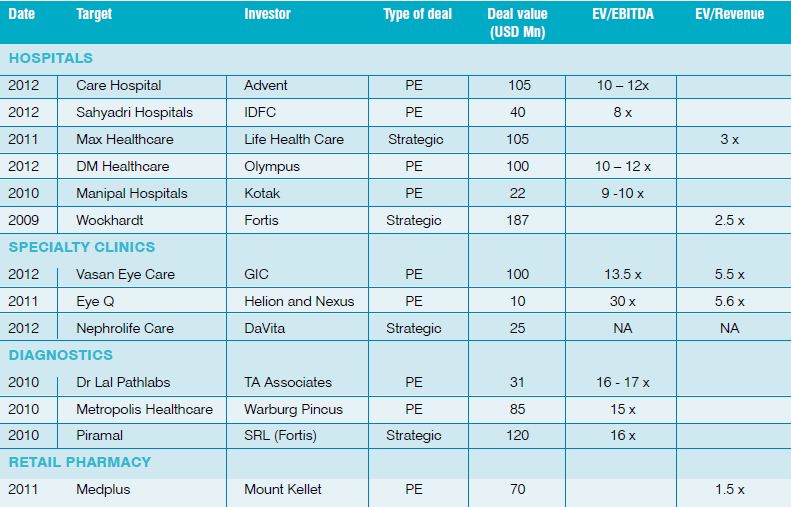

List of companies that got funded recently

Be a part of Elets Collaborative Initiatives. Join Us for Upcoming Events and explore business opportunities. Like us on Facebook , connect with us on LinkedIn and follow us on Twitter , Instagram.