Would global (and Indian) financial markets have tanked this badly (and perhaps even more in offing) had #coronavirus hit in different circumstances? Perhaps not. No doubt corona would have a massive real toll on the economy. But it would be a transitory phenomenon. Economic activities will resume in a few weeks/months. Its like an earthquake and tsunami, causes massive destruction in its wake, but soon economic activity picks up to make up for the losses. As the world learns to embrace corona, economic activity would resume and a significant portion of the loss would be made up. But then why are markets behaving as if corona is going to cause a permanent harm to economic activity?

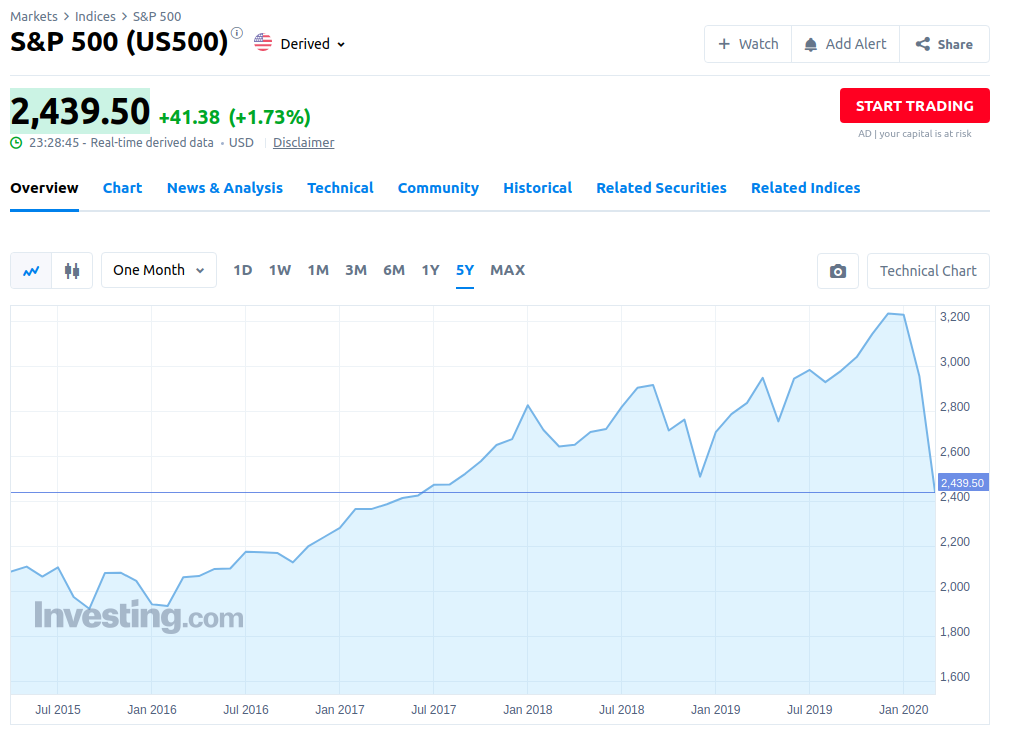

That is why we say, had the virus hit in good times, we would have seen a V-shaped recovery. A blip and then back to normal. But here, the truth is that in the past 3-4 years, markets had lost connection with the real economic forces and were rising and rising even as economic fundamentals were getting weaker and weaker. The situation was becoming more and more unsustainable, until corona forced a reality check. We will explain everything with the help of a few charts:

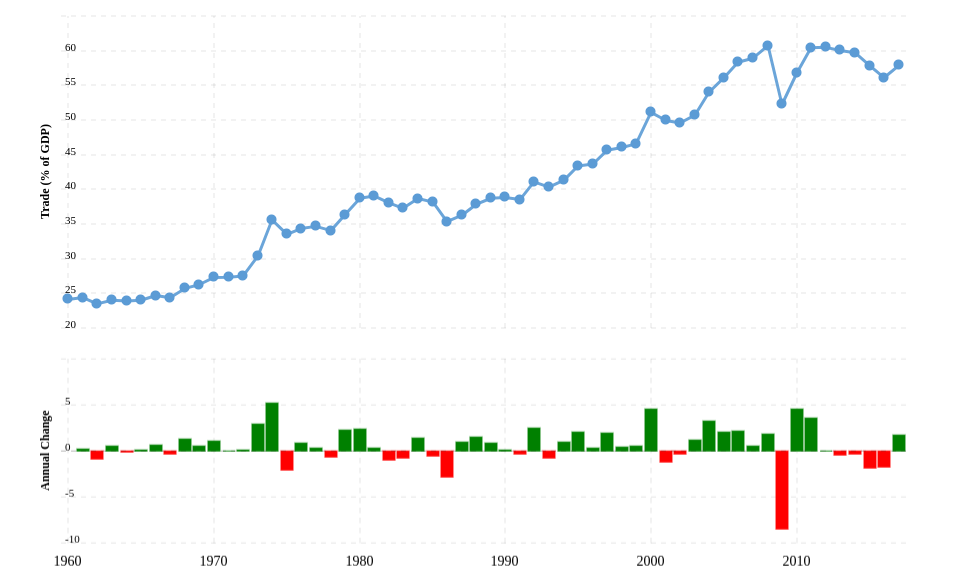

The chart below shows global trade as a percentage of global GDP vs time on x-axis. Trade acts as one of the biggest engines of growth because it brings efficiency to the economy. As one can see, after a secular rise from 60s until the Great Financial Crisis of 2008, global trade never really recovered and is on a structural downturn. WTO is all but dead, globally free trade agreements are being torn off, US and China are fighting a trade war and almost all countries including India are putting up tariff and non-tariff barriers. So… trade goes down, and with it economic prosperity and growth.

Countries are resorting to more and more protectionism. Once, it happened before too and that was in the decade following the First World War i.e. in 1920s as can be seen in the chart below… As a side note, no student of history needs to be reminded of what happened as a consequence – The Great Depression of 1929 and 30s… rise of fascism and socialism and a violent world. These are natural consequences of a poorer world.

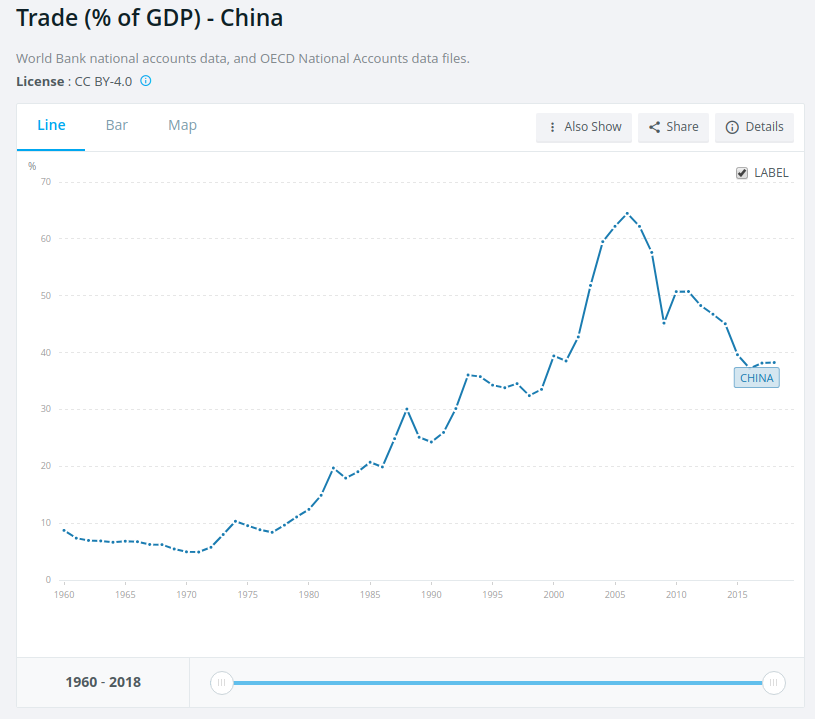

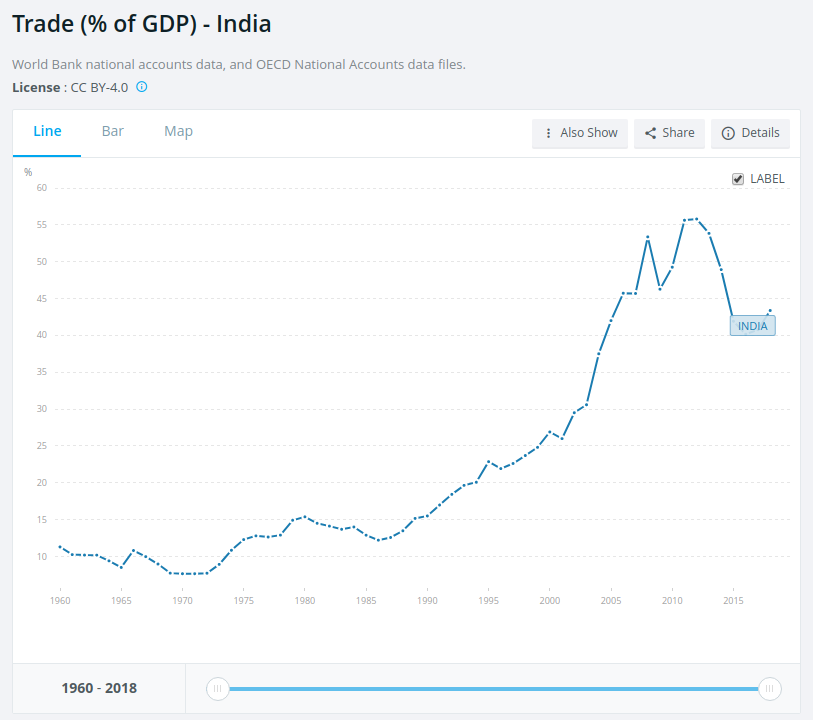

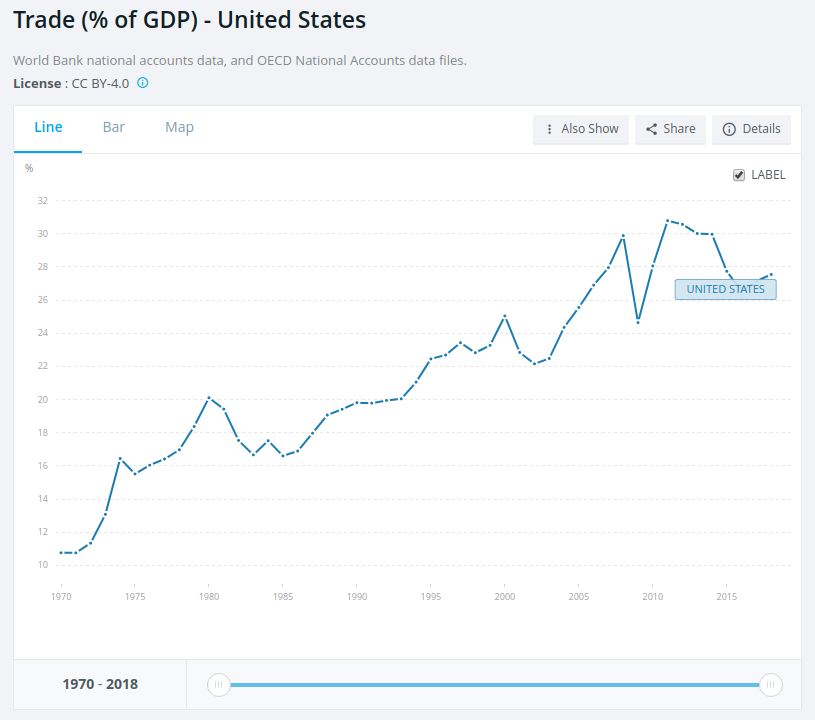

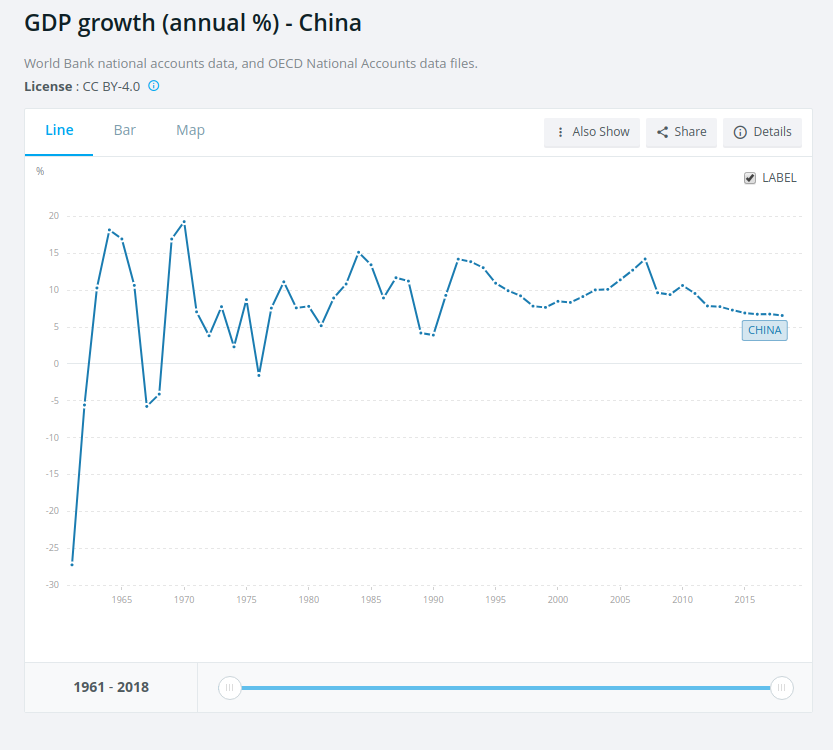

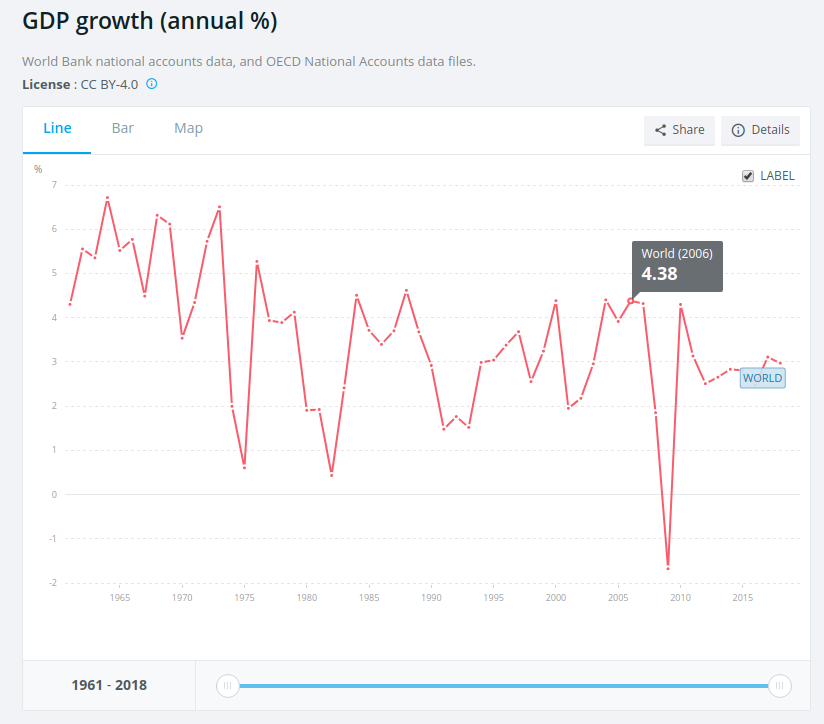

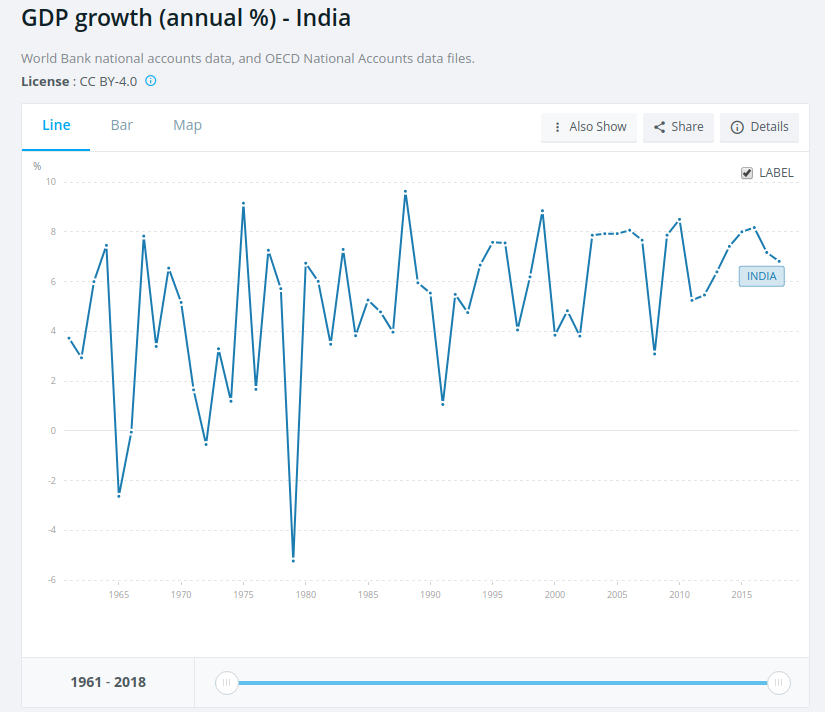

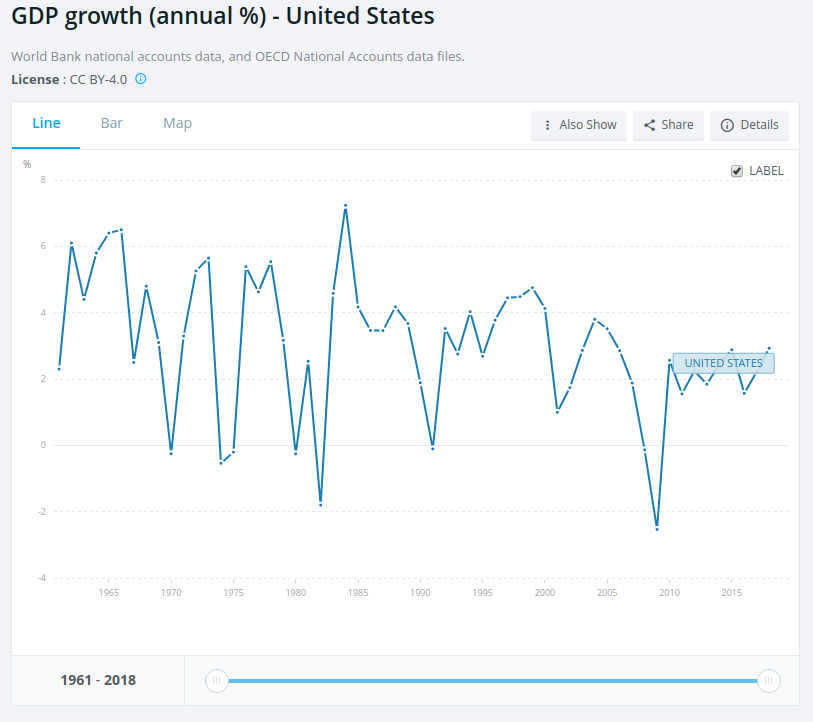

The result of trade shrinkage on GDP growth is evident from the charts below. The world GDP growth rate has been anaemic for past 6-7 years, US subdued, China fallen off sharply and in India – due to introduction of new GDP series in 2014 and not providing a backseries, the pre and post 2014 rates are not comparable – still, by the new series also, the growth has been faltering for the past 3 years.

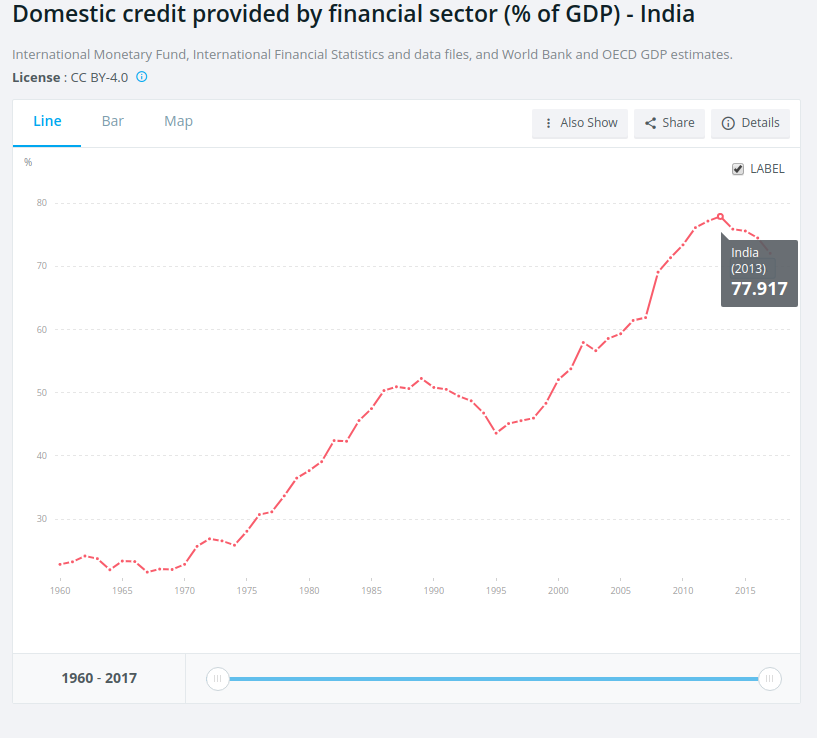

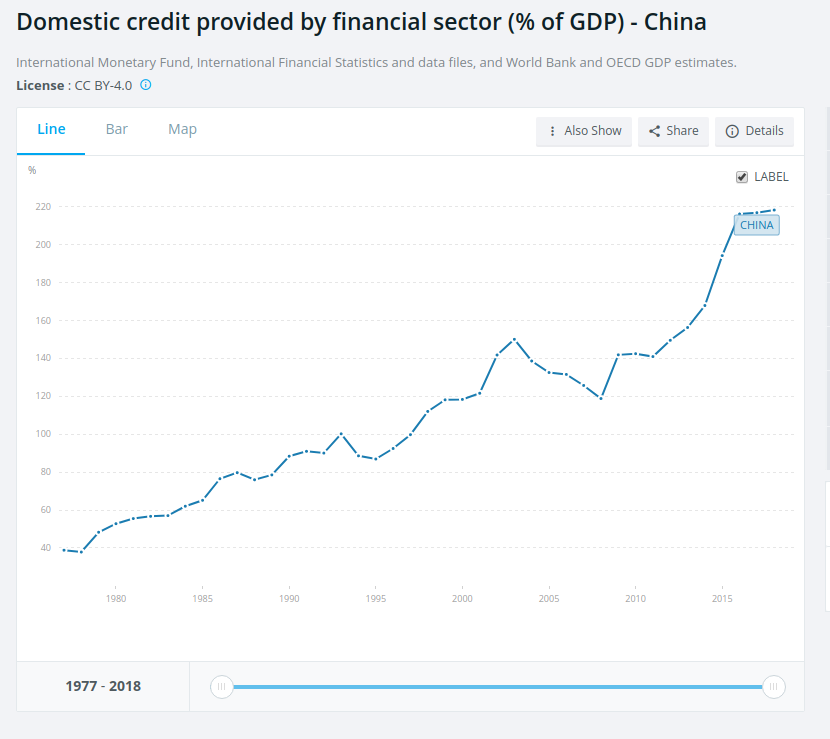

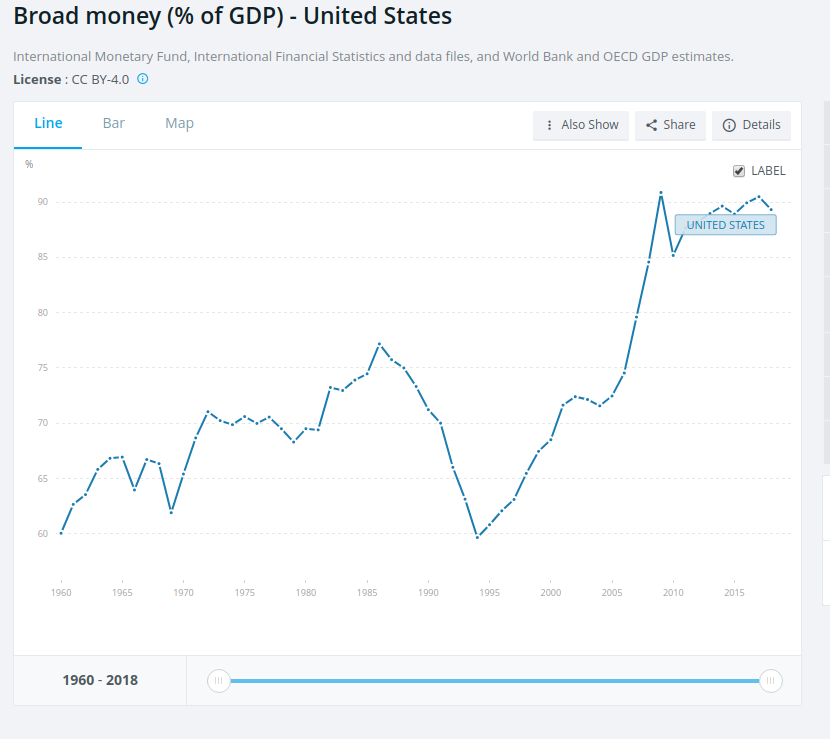

Amidst all this, India has been suffering from another problem – poor corporate governance structures or in plain simple terms – corruption. Lot of promoters took loans from banks, had a gala time along with the bankers and then wilfully defaulted. The banks, instead of classifying the loans as NPAs or defaults, simply “restructured” them where interest and principal repayments were deferred. This was simply kicking the can down the road. As you can see, post 2013 when with Raghuram Rajan at helm, RBI clamped down on this practice and forced the banks to classify them as NPAs, the party ended and frauds hidden for years began to surface. The move saved economy from a certain disaster but as a consequence, also made banks averse to lending and virtually all lending stopped. So in the charts below, one can see that the domestic credit generated by the financial sector as a percent of GDP tanked for India whereas it continued business as usual in China and USA.

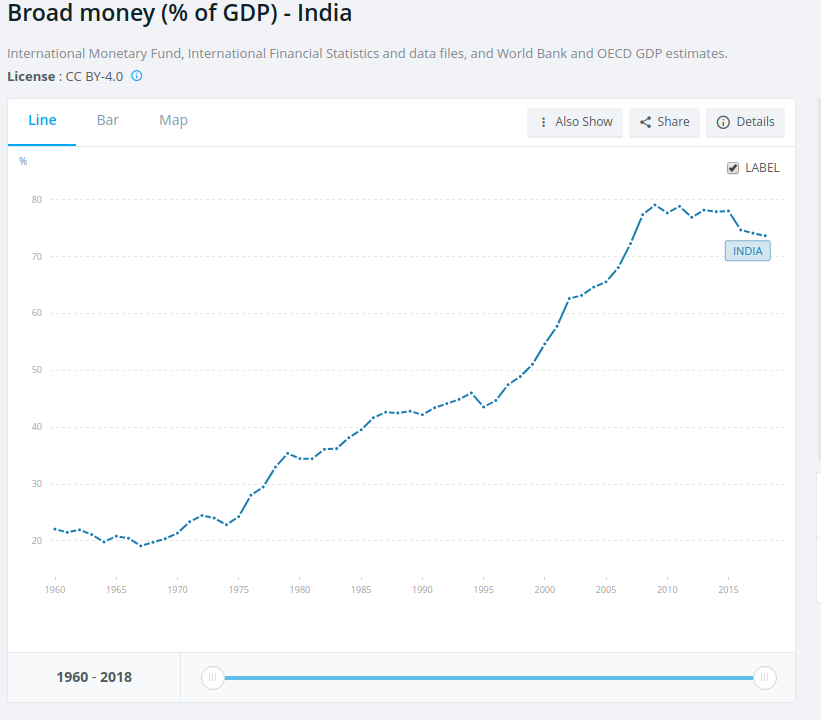

Another way of seeing this is looking at the broader money supply (which includes mainly the credit created by banks) as a percentage of GDP. Here also one notes that India’s M3 tanks sharply during this period.

Thus the fundamentals of economy – the things which drive it – kept on getting weaker and weaker. And the markets, surprisingly kept on going higher and higher. Perhaps to a point, where they were already flying on empty tanks when the corona hit.

Markets cannot remain decoupled from the real economy for long. An asset price bubble can only last that much. Perhaps the permanent destruction in demand which they are now pricing in are a result of dying engines of growth due to rising protectionism, lack of economic reforms and poor corporate governance.

(WRITTEN BY Gaurav Agarwal, IAS, IIT & IIM Graduate, currently posted as Commissioner, Ajmer Development Authority)

Be a part of Elets Collaborative Initiatives. Join Us for Upcoming Events and explore business opportunities. Like us on Facebook , connect with us on LinkedIn and follow us on Twitter , Instagram.

"Exciting news! Elets technomedia is now on WhatsApp Channels Subscribe today by clicking the link and stay updated with the latest insights!" Click here!