Amit Chander, Head-Investment Healthcare, Baring PE Partners Ltd, is of the opinion that the Indian healthcare is encouraging investors more than ever before.,

How well is the Indian healthcare sector doing when it comes to attracting investment funding? What elements the sector has that make it investment worthy or vice-versa.

Indian healthcare sector is a preferred foreign investment destination for a variety of reasons. The sector is attractively positioned to grow at twice the growth rate of Indias GDP given favourable demographics, increasing affordability and improving access to healthcare over the next several years. Take demographics for instance, it is estimated that for the next 40 years almost 500 million people in India will either be below 15 years of age or be more than 60 years of age implying nearly 40 percent of the population will be in an age that is vulnerable to medical problems and will demand healthcare interventions of some nature or the other. International studies have shown that as a nation gets wealthier, it

spends more and more on the healthcare needs of its population.

In your opinion what kind of investment trend the Indian healthcare is showing? Is the sector able to attract good amount of funding both from domestic and overseas investment market?

There is no dearth of capital for healthcare ventures in India with investors actively allocating capital across the value chain from pharmaceuticals to hospitals and diagnostics. Most of the capital is going to medium size companies where

investors take up minority equity interest and partner with the entrepreneurs in taking the business to the next level. This could mean expanding manufacturing facilities or opening up new clinics or hospitals or for market expansion purposes. The availability of capital though is fairly scarce and limited for early stage, start-up ventures which are working on innovative technologies. Limited evidence of high returns being generated by ventures in this area has resulted in only a select group of investors to operate in this part of the value chain.

What are the criteria that an investor looks at in a healthcare company before investing? Apart from funding what other assistance do they offer to them?

There are four parameters that investors look for strong growth outlook for the business, high return on capital profile of the company, ability to scale the company to get a meaningful exit through an IPO within 5-6 years and strong corporate governance being followed by the entrepreneur. The first factor is typically external and a single entity can do little to influence it. PE funds assist the entrepreneur in the remaining three aspects. Helping identify scale efficiencies, operating best practices and good managerial talent can significantly improve the chances of successful scale-up. Designing strong board processes, augmenting the audit function, recruiting independent directors are all areas in which PE funds can contribute very positively.

Do the investors remain on board till the company breaks even? If not, what is the exit policy that such investment company follows in healthcare?

The decision to exit is driven by two considerations the life of the investors fund and the maturity of the business to support an exit event. All investors invest from funds with a finite life and have to exit their portfolio companies when the fund life comes to an end. Astute investors match the maturity profile of the business they are investing in with the life of their fund. They would prefer that the business model of the company is well established by that time in terms of scale, profitability and management depth to make it an attractive investment for either other financial investors or a strategic partner. If neither is possible then buyback of their shares by the company is an option. Given the strong interest of investors in the Healthcare sector more often than not an exit is feasible by selling to another financial investor.

Naresh Malhotra, Director, Modern Family Doctor Pvt Ltd, has a successful track record in launching and establishing multiple brands in various healthcare segments. He shares his insights.

How well the Indian healthcare sector is doing in terms of attracting investment funding?

The healthcare sector is attracting the maximum attention today from Private Equity and Venture Capital. The Investors see a huge potential, with a growing population and a highly underserved market. Add to this the higher incomes, more disposable incomes, lack of facilities provided by the Government and you can understand why everyone wants to invest in the healthcare sector.

What are the criteria that an investor looks at in a healthcare company before investing in? Apart from funding what other assistance they offer to such companies?

An investor wants to see rapid growth, profitability, faster scalability and will look at entrepreneurs who are either going into niche spaces or enjoy the advantage of being the first entrant in any niche market. They like to go to markets which have a huge potential. Other assistance which VCs, PEs provide is getting best practices, overseas tie ups, bench marking with best of breed and corporate governance.

Can you please mention a few healthcare companies got recently funded?

Nationwide, Nova, Express Clinics, Vatsalya, and Mulchand Hospital have received funding recently.

Meet The Risk Mitigator

Vishal Gandhi, Managing Partner and CEO, BIORx Venture Advisors Pvt Ltd, shares his thoughts on the investment scenario for Indian healthcare sector.

In your opinion, what kind of investment trend is Indian healthcare showing?

Healthcare as a sector started attracting private investment only about ten years ago. Before that it was regarded as a charity field wherein no profitable venture could be thought of. But thanks to healthcare enterprise chains like Fortis/Apollo, the scenario has changed. In these past few years, we have witnessed more and more private investment,

merger and acquisitions in the sector. This is a need of the hour considering we are a country where the bed to patient ratio stands at one bed for a thousand patients. In order to change this scenario, Private investment is the only way forward to change this scenario. The healthcare sector has huge potential to attract investment given we are a country of more than 1.2 billion population and 75 percent rural population still has to travel few hundred kms to get decent treatment for even most common diseases.

What criteria an investor looks at in a healthcare company before investing?

First and foremost , a start-up or a company should only approach the angel investors/ VC/PE once they have established a proof of concept from their own equity or money raised from family/friends. The investors look into the robustness of business plan the company has. They also look at the following areas:

b) How scalable the business in terms of entry barriers?

c) How well networked the promoters are

d) How is the management team of the company and also what retention policy the company has for their employees.

What are the steps a healthcare company opts before finalising a VC or PE funding?

Before finalising a VC make sure you have all the elements needed to make your venture attractive in the eyes of the investors. Right from a sound business plan to well planned out revenue model everything has to be in sync with the nature of the business so that the investors do not get a chance to turn down the proposal. Make sure the investors are from the same domain and they have domain expertise that would give value addition along with funding.

What is the role of BIO Rx?

We play the role of risk-mitigators. Because of my professional experience I can suggest ways to companies that they may not even think of. Sitting in a cabin you would assume you are the best, but we as an experienced party who has learnt the tricks of the trade by working for similar companies across the value chain and life cycle of company, BioRx can guide them about ways to avoid risks when choosing investment partners. Because many a times, a company needs a debt and ends up taking a private equity investment. So we can tell them if they should go for a debt or equity depending upon whats the best capital structure

The Investment Roadmap

Amit Mookim, Partner, Strategy Services Group, National Industry Head Healthcare, KPMG, feels the investment scenario for Indian healthcare is changing for good

How well is the Indian healthcare sector doing in terms of attracting investment funding?

Healthcare is emerging as one of the top interest areas for private equity and venture capital investors. Rapid growth prospects, lack of scale in businesses and increasing market size in India makes it an interesting avenue for funding.

In your opinion what kind of investment trend the Indian healthcare is showing?

The sector is attracting funding from both domestic corporate, domestic investors and overseas investors. The reference is across various delivery models both asset light and scalable, such as eye care, ambulatory care, IVF

clinics, dialysis centres as well as multispecialty hospitals

What are the criteria that a PE/VC/ Insurance company looks at in a healthcare company before investing in?

Management team, depth of talent, economic soundness of the idea and ability to deliver, scalability of the model, ability

to exit in a finite timeframe, are some of the criteria that an investor looks at in the healthcare company. Apart from

funding, some investors play an active role in influencing strategy, getting management personnel on board, opening

new market opportunities/ contacts and institutionalising processes.

What is the exit policy that such investment company follows in healthcare?

Growing companies need several series of funding, and this is the same in healthcare. Some investors dilute partially

during ensuing exit rounds, but at the same time, in a sector like healthcare, given the size of companies, exit through IPO etc is still a distance away.

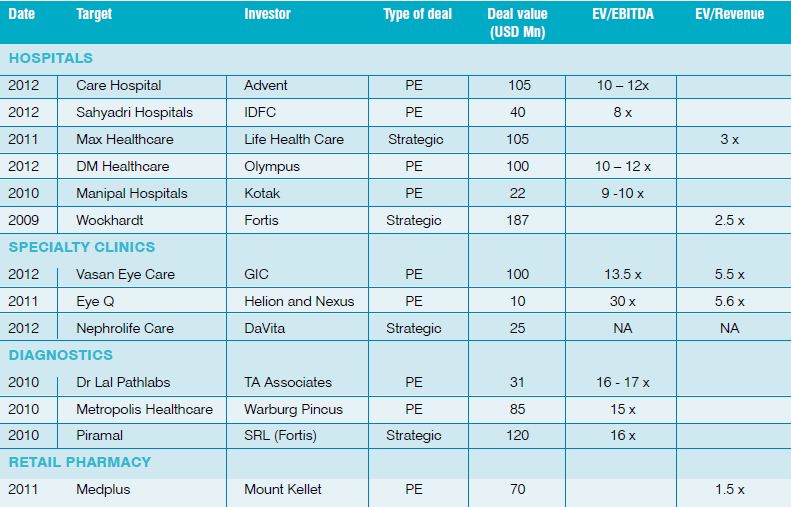

List of companies that got funded recently

Be a part of Elets Collaborative Initiatives. Join Us for Upcoming Events and explore business opportunities. Like us on Facebook , connect with us on LinkedIn and follow us on Twitter , Instagram.